What is a home inventory?

- A home inventory is an itemized list of all of your possessions.

Why should I have a home inventory?

- Having a current, comprehensive home inventory—whether your home is a house, apartment, boat, RV, or other type of dwelling—is extremely important, and it’s much easier to make before you need it.

- In the event that any of your possessions are lost or damaged as a result of a natural disaster, house fire, or break in, you’ll need to be able to provide a detailed list of your losses if applying for disaster assistance, submitting an insurance claim, or filing a police report. In the case of insurance, the more proof you can provide of the value of your losses, the easier it will be for you to be fully compensated for them (up to the limits of your policy).

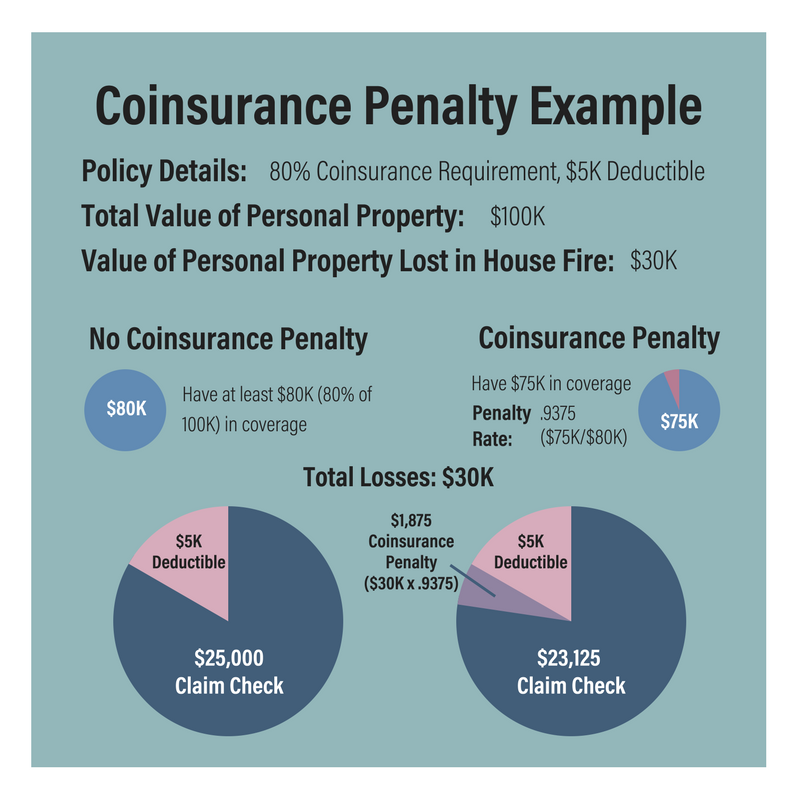

- In order to make sure you have enough insurance coverage in the first place, you have to know what you own. Some insurance policies require you to insure a certain minimum percentage of the value of your covered property (80% is common). This is called a coinsurance clause or requirement. If you don’t carry enough insurance, you can be penalized when filing a claim.

How do I make a home inventory?

Writing Your Inventory

- A home inventory is an itemized list of all of your possessions. If you’re missing information, include your best estimates in your inventory.

- There are many different ways you can organize your inventory. Many people use a spreadsheet and digital photo folder. Others use an online tool or app provided by their insurance company. (Check with your insurance company to see if they offer one.) There are also free tools available, such as the UPHelp Home Inventory and myHome Scr.APP.book apps. Whatever method works best for you, make sure your inventory is stored safely and that you have a backup copy stored outside your home / can still access your inventory even if your home or computer is damaged.

- It’s a good idea to update your inventory yearly. For any major purchases you make throughout the year, be sure to add them to you inventory as soon as you can.

Visual Record

- Depending on the volume of your possessions, it can take some time to complete your inventory. If you’ve never done an inventory before, an easy way to get started is to make a simple visual record of your home. Go room to room with a camera and take videos or photos. Be sure to open up drawers, cupboards, and closet doors. While the visual record won’t capture everything, this will give you a good place to start when you put together a detailed list.

Item Values

- For more valuable items such as furniture and electronics, you’ll want to include as much relevant information as possible: make, model, serial number, purchase date, photo of the item and receipt. (Ink on receipts can wear off over time, so it’s always a good idea to make a copy).

- Actual Cash Value (ACV) Policies

- If you have an actual cash value (ACV) policy, you will be compensated for the value of an item less depreciation. (Most items lose value over time, and in an actual cash value policy you’re covering them for what they’re worth today, not what they were worth at the time you bought them.) Your insurance company uses information about item type, age and purchase price to determine value.

- Replacement Cost Policy

If you have a replacement cost policy, you will be compensated for the value to replace eligible lost items with new ones of similar kind and quality. Including replacement cost estimates in your inventory can help you make sure you are carrying enough insurance for the full value of what you own.

Possessions Stored Outside of the Home

- Make sure your inventory includes any items you store in other locations, such as a basement, garage, shed, storage unit or trunk of your car. For items stored outside your home, it’s a good idea to double check that they are covered under the terms of your insurance policies. If they’re not, you may either want to make a change to your policy or move the items to a location that is covered.

Building Materials and Structural Upgrades

- Be sure to include any special building materials or upgrades to the actual structure of your home. For example, if you recently installed granite countertops, premium carpeting, custom window treatments, etc., be sure to include photos and receipts in your inventory.

For more tips, check out SBP’s Home Preparedness Checklist and Resource Guide.